Cit bank add joint account holder – Citibank add joint account holder—a seemingly simple process, yet one brimming with intricacies. This guide unravels the complexities of adding a joint account holder at Citibank, covering everything from eligibility requirements and security protocols to managing the account and resolving potential issues. We’ll explore the various account types, the necessary documentation, and the steps involved in both online and in-person applications, ensuring a smooth and informed experience for all.

Understanding the nuances of joint accounts is crucial, especially given the shared responsibilities and financial implications. This comprehensive guide aims to equip you with the knowledge needed to navigate this process confidently, whether you’re adding a spouse, family member, or business partner. We’ll delve into the legal and practical aspects, empowering you to make informed decisions and avoid potential pitfalls.

Navigating the World of Citibank Joint Accounts

Embarking on a financial journey with a joint account can be a rewarding experience, especially with a reputable institution like Citibank. This comprehensive guide unravels the intricacies of adding a joint account holder, ensuring a smooth and informed process. We’ll cover everything from the initial steps to managing your account and addressing potential challenges along the way.

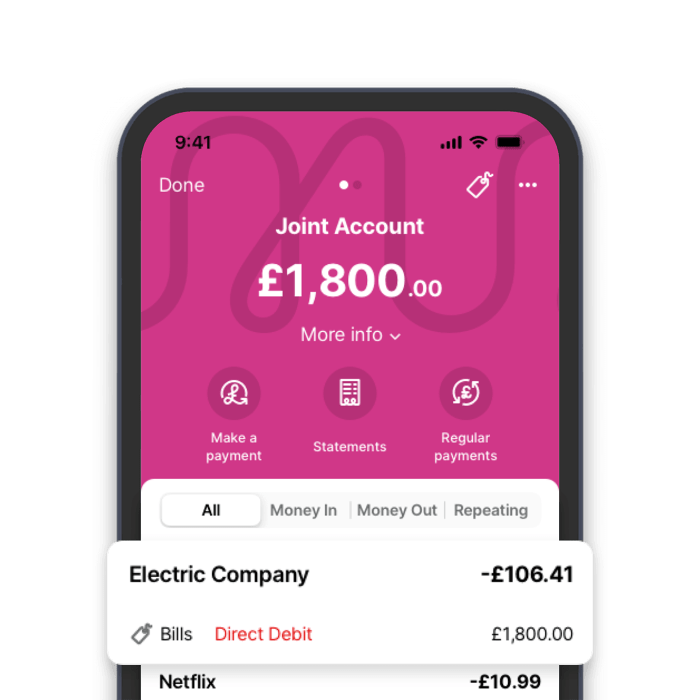

Citibank’s Joint Account Process

Source: virginmoney.com

Adding a joint account holder at Citibank involves a straightforward process, but careful attention to detail is crucial. This section Artikels the steps, required documentation, account types, and a step-by-step online guide.

The steps typically involve submitting an application, providing necessary documentation, and receiving confirmation from Citibank. Documentation usually includes government-issued IDs, proof of address, and potentially additional documents depending on the account type and individual circumstances.

Thinking of adding a joint account holder to your CIT Bank account? It’s a great way to manage finances together, but understanding how interest works is key. Check out this resource to learn when CIT Bank pays interest: cit bank when is interest paid. Knowing this will help you plan effectively, especially when considering joint account implications for interest accrual and payouts, ensuring a smoother experience for all account holders.

Citibank offers various joint account types, each tailored to different financial needs. These may include standard joint accounts, joint accounts with survivorship rights (where the surviving account holder inherits the funds), and potentially others depending on the specific offerings in your region.

Online Process for Adding a Joint Account Holder

- Log in to your Citibank online banking account.

- Navigate to the “Accounts” or “Manage Accounts” section.

- Locate the option to add a joint account holder.

- Provide the required information about the new joint account holder.

- Upload the necessary documentation.

- Review and submit the application.

- Receive confirmation from Citibank.

Comparison of Citibank Joint Account Types

| Account Type | Features | Benefits | Drawbacks |

|---|---|---|---|

| Standard Joint Account | Equal access and control for all holders. | Simplified management for shared finances. | Potential for disputes if not managed properly. |

| Joint Account with Survivorship Rights | Surviving holder inherits the account upon the death of another. | Streamlined inheritance process. | May have slightly different account management procedures. |

| (Add other account types if applicable) | (Describe features) | (Describe benefits) | (Describe drawbacks) |

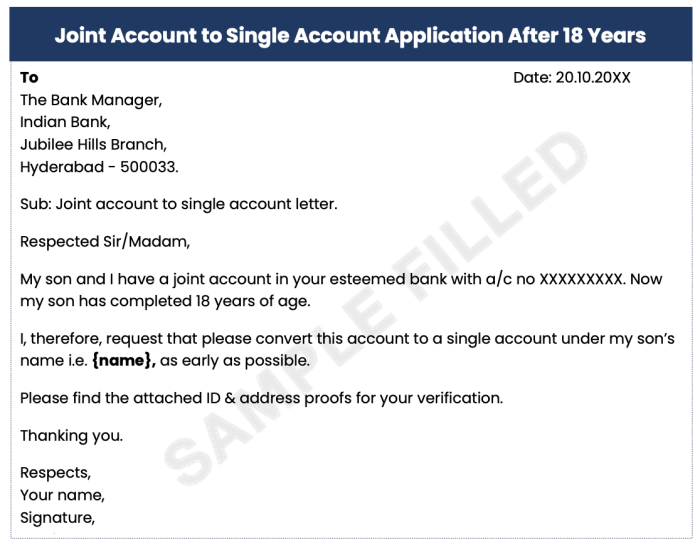

Eligibility Requirements for Joint Account Holders

Source: samplefilled.com

Eligibility for a Citibank joint account hinges on several factors. Understanding these criteria is crucial before initiating the application process. This section covers age restrictions, residency requirements, creditworthiness assessments, and beneficial situations for joint accounts.

Generally, both applicants must meet Citibank’s minimum age requirement (typically 18 years old) and provide proof of residency. Citibank may conduct a creditworthiness assessment on both applicants, considering their individual credit history to assess the risk associated with the account.

Adding a joint account holder can be advantageous in various situations, such as managing shared expenses, facilitating inheritance planning, or providing financial support to a dependent.

Frequently Asked Questions Regarding Eligibility

- What is the minimum age requirement for a joint account holder?

- What documentation is needed to prove residency?

- How does Citibank assess the creditworthiness of joint account holders?

- Can non-residents open a joint account?

- What happens if one joint account holder has poor credit?

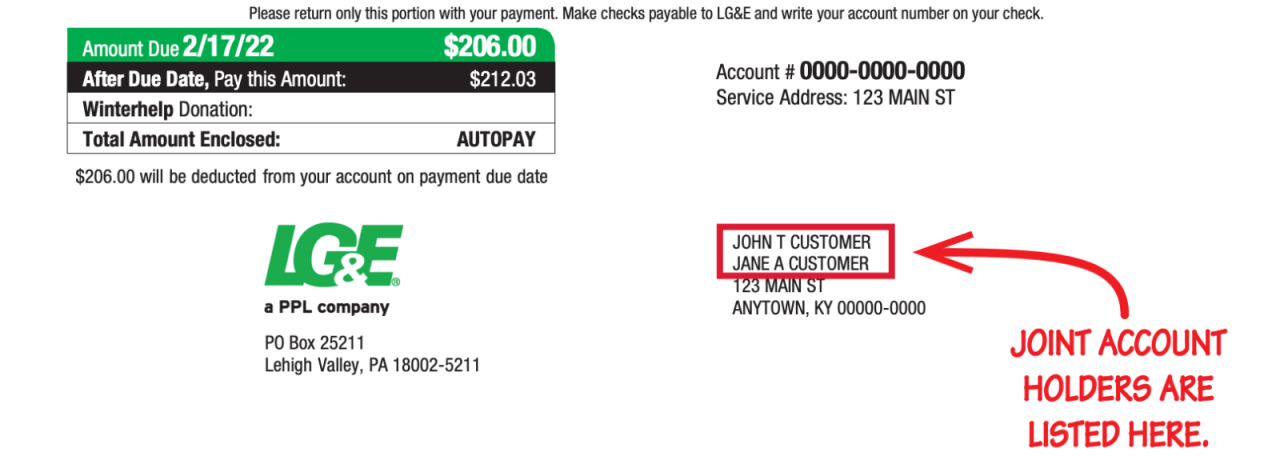

Security and Privacy of Joint Accounts

Source: lge-ku.com

Citibank prioritizes the security and privacy of all its accounts, including joint accounts. Understanding the security measures, responsibilities of each holder, and the process for reporting suspicious activity is essential for maintaining the integrity of your finances.

Citibank employs robust security measures such as encryption, fraud detection systems, and multi-factor authentication to protect joint accounts from unauthorized access. Each joint account holder is responsible for safeguarding their personal login credentials and reporting any suspicious activity immediately. Citibank adheres to strict privacy regulations, ensuring that personal information is handled responsibly and confidentially.

Managing Access Permissions

Managing access permissions might involve setting transaction limits, designating specific account functionalities for each holder, or restricting certain actions. These controls can be adjusted based on the needs and preferences of the account holders.

Reporting Suspicious Activity, Cit bank add joint account holder

The process for reporting suspicious activity usually involves contacting Citibank’s customer service department immediately, providing details of the suspected fraudulent activity, and following their instructions for further investigation.

Managing a Citibank Joint Account

Effective management of a joint account requires clear communication and shared responsibility between the account holders. This section details the responsibilities, transaction handling, removal process, and best practices for managing finances in a joint account.

Both joint account holders typically have equal rights and responsibilities regarding the account, unless otherwise specified. Transactions are recorded and accessible to both parties. Removing a joint account holder usually requires a formal request to Citibank and mutual agreement from all account holders.

Best Practices for Managing Finances

Best practices include regular account reconciliation, setting clear spending budgets, and maintaining open communication about financial goals and spending habits.

Flowchart for Making a Withdrawal

A flowchart illustrating the process of making a withdrawal would visually depict the steps involved, from initiating the transaction to receiving confirmation. This would typically include selecting the withdrawal method, entering the amount, and verifying the transaction.

Potential Issues and Resolutions

Despite careful planning, issues can arise when managing a joint account. Understanding potential problems and their solutions is key to maintaining a smooth financial partnership. This section covers common problems, dispute resolution, implications of a joint account holder’s death, and a summary table of common issues and their solutions.

Potential issues may include disagreements over spending, unauthorized transactions, or disputes regarding account management. Citibank typically provides dispute resolution mechanisms, such as mediation or arbitration, to help resolve conflicts between joint account holders. In the event of a joint account holder’s death, Citibank will follow established procedures regarding the account’s continuation, often involving the surviving holder and potentially legal documentation.

Common Problems and Solutions

| Problem | Solution | Contact | Timeline |

|---|---|---|---|

| Disagreement over spending | Open communication, budgeting, financial counseling | Citibank customer service | Ongoing |

| Unauthorized transaction | Report to Citibank immediately | Citibank fraud department | Immediate reporting crucial |

| Death of a joint account holder | Follow Citibank’s procedures for deceased account holders | Citibank legal department, executor | Variable depending on legal requirements |

Closing Summary: Cit Bank Add Joint Account Holder

Adding a joint account holder at Citibank offers numerous benefits, from streamlined financial management to enhanced security and contingency planning. However, it’s crucial to understand the shared responsibilities, legal implications, and potential challenges involved. This guide has provided a detailed overview of the process, from eligibility requirements and account management to addressing potential disputes and security concerns. By carefully considering these factors and following the steps Artikeld, you can confidently add a joint account holder and enjoy the benefits of shared financial control.