Cit bank referral program – Citibank referral program offers a lucrative opportunity to earn rewards by referring friends and family. This program provides significant benefits for both the referrer and the referee, incentivizing participation through attractive rewards and streamlined processes. Understanding the program’s structure, eligibility criteria, and rewards is key to maximizing its potential. This guide delves into the specifics, providing a comprehensive overview to help you navigate the program effectively and unlock its rewards.

From understanding the eligibility requirements and the various reward tiers to mastering the referral process and maximizing its promotional potential, this guide offers a detailed exploration of the Citibank referral program. We’ll examine the terms and conditions, analyze customer experience aspects, and discuss key performance indicators to fully understand this valuable program.

Citibank Referral Program: A Deep Dive: Cit Bank Referral Program

Source: uthrive.club

Sharing the good news about the CIT Bank referral program is like spreading the word of faith! To truly understand the scope of CIT’s offerings, it’s helpful to explore their relationship with other institutions, such as learning more about the connection between CIT Bank and one west bank cit bank. This deeper understanding can enhance your ability to effectively share the benefits of the CIT Bank referral program with others, allowing more people to experience its blessings.

Citibank’s referral program, a carefully calibrated engine of growth, offers a compelling proposition for both existing and prospective clients. It’s a symbiotic relationship, built on mutual benefit and strategic expansion. This analysis delves into the program’s intricacies, examining its structure, rewards, eligibility, and overall effectiveness. We’ll dissect the mechanics, highlighting both the opportunities and potential challenges, all viewed through a lens of pragmatic analysis.

Referral Program Overview

Citibank’s referral program operates on a straightforward principle: existing customers refer new clients, and both parties receive rewards. The structure is tiered, with rewards escalating based on the number and type of referrals successfully completed. Referrers benefit from financial incentives, while referees often gain access to preferential onboarding offers or exclusive perks. The program’s success hinges on its simplicity and the tangible value proposition for all involved.

Participation involves sharing a unique referral link or code with prospective clients. Once the referee completes specific actions (like opening an account or securing a loan), both parties are credited with their respective rewards. The process is designed to be seamless, leveraging digital platforms for ease of access and tracking.

| Program Name | Referrer Reward | Referee Reward | Eligibility Requirements |

|---|---|---|---|

| Citigold Referral Program | $500 cash bonus per successful referral | Waived account fees for the first year | Existing Citigold client, referee meets specific wealth management criteria |

| Citi Premier Referral Program | $250 cash bonus per successful referral | $100 cash bonus and reduced interest rate on personal loan | Existing Citi Premier client, referee meets specific credit score and income criteria |

| Citi Simplicity Referral Program | $100 cash bonus per successful referral | $50 cash bonus and waived monthly fees for the first 6 months | Existing Citi Simplicity client, referee meets basic eligibility criteria |

Eligibility Criteria

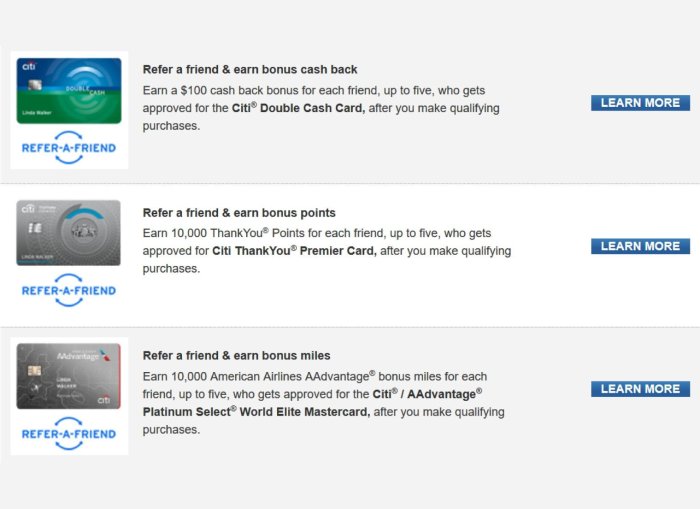

Source: boardingarea.com

Strict eligibility criteria ensure the program’s integrity and prevent abuse. Referrers must be existing Citibank customers in good standing, meeting specific criteria depending on the program. Referees must also meet specific criteria, often related to creditworthiness, income levels, and residency status. Ineligibility might arise from past account issues, fraudulent activity, or non-compliance with Citibank’s terms and conditions.

The eligibility process involves a verification check on both the referrer and the referee’s information. This ensures that only qualified individuals participate, maintaining the program’s integrity and preventing abuse.

Rewards and Incentives, Cit bank referral program

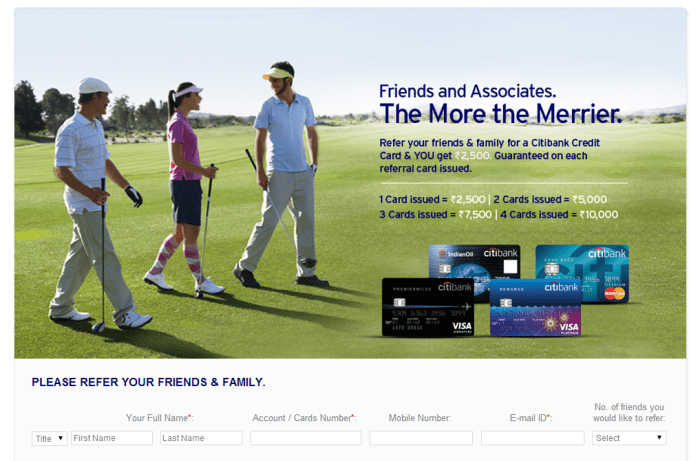

Source: com.sg

Rewards are structured to incentivize both referrers and referees. Referrers typically receive cash bonuses or statement credits, while referees benefit from reduced fees, interest rate discounts, or cash bonuses. The value proposition for each party is clearly defined, making the incentive compelling and easily understood.

- Cash bonuses

- Statement credits

- Waived fees

- Interest rate discounts

- Exclusive perks and offers

Terms and Conditions

Comprehensive terms and conditions govern the referral program, addressing aspects such as eligibility, reward payouts, timelines, and limitations. Understanding these terms is crucial for both referrers and referees to avoid misunderstandings or disqualification. Violations can include fraudulent referrals, providing false information, or failing to meet specific requirements Artikeld in the program guidelines.

- Compliance with all applicable laws and regulations

- No referral of immediate family members or employees

- Accurate and truthful information provided throughout the referral process

- Adherence to Citibank’s privacy policies and data protection standards

Referral Process

Referring a friend or family member is typically straightforward. Referrers access their unique referral link or code through online banking or the Citibank mobile app. This link is then shared with the prospective client, who uses it to complete the application process. Effective referral communication involves personalized messaging that highlights the benefits for both parties.

A sample email might include:

Subject: Exclusive Offer: Join Citibank and We Both Benefit!

Hi [Referee Name], I wanted to share an exciting opportunity with you. As a Citibank customer, I can refer you to a special program where we both receive rewards. Learn more and apply using this link: [Referral Link]. Let me know if you have any questions. Best, [Referrer Name]

Program Promotion and Marketing

Citibank utilizes various channels to promote its referral program, including email marketing, social media campaigns, and in-branch promotions. The effectiveness of these strategies is tracked through key performance indicators (KPIs), allowing for adjustments based on performance data. Comparisons with competitor banks’ referral marketing reveal best practices and areas for improvement.

A comprehensive marketing plan might include targeted email campaigns, social media advertising, and partnerships with complementary businesses.

Customer Experience

A seamless customer journey is crucial for the program’s success. Potential pain points include confusing instructions, lengthy processing times, or lack of communication. Improving the customer experience involves simplifying the process, providing clear instructions, and ensuring prompt responses to queries.

| Issue | Solution |

|---|---|

| Difficulty finding the referral link | Prominently display the referral link on the website and mobile app. |

| Lack of communication updates | Provide regular email updates on the referral status. |

| Complex reward structure | Simplify the reward structure and provide clear explanations. |

Program Performance and Metrics

Key performance indicators (KPIs) for evaluating the referral program’s success include the number of referrals generated, the conversion rate (percentage of referrals resulting in new accounts), and the overall cost per acquisition. Citibank could track and analyze these metrics using its CRM system and other data analytics tools. Regular monitoring and adjustments are vital to optimize the program’s effectiveness.

A hypothetical performance report might highlight a significant increase in referrals during specific promotional campaigns, a high conversion rate among referred clients, and a decrease in the cost per acquisition due to improved marketing efficiency. This data would be used to inform future strategies and optimize the program for maximum impact.

Closing Summary

The Citibank referral program presents a compelling opportunity to earn rewards while helping others access valuable financial services. By understanding the program’s structure, eligibility, rewards, and terms, you can effectively leverage its potential. Remember to adhere to the terms and conditions, and utilize effective referral strategies to maximize your rewards. Regularly reviewing the program details and staying updated on any changes will ensure continued success in leveraging this beneficial program.