Wells Fargo credit card online access opens a world of convenience and control. This isn’t just about paying bills; it’s about navigating a sophisticated financial ecosystem, from applying for a card to managing rewards and resolving disputes. We’ll delve into the intricacies of the online experience, exploring its features, security, and customer service, painting a comprehensive picture of how Wells Fargo empowers its cardholders digitally.

This exploration will cover the entire online journey, from the initial application process and its various methods – online, in-person, or via phone – to the daily management of your account, including payments, statement viewing, and dispute resolution. We’ll analyze the robust security measures in place, comparing them to industry standards, and examine the various customer service channels available for support.

Finally, we’ll uncover the secrets to maximizing your Wells Fargo credit card rewards program online.

Wells Fargo Credit Card Online Application Process

Applying for a Wells Fargo credit card online offers a convenient and efficient alternative to in-person or phone applications. This process typically involves a few simple steps, requiring specific personal and financial information. The online method often provides immediate feedback, unlike other application methods.

Steps Involved in the Online Application

The online application process for a Wells Fargo credit card is straightforward. It generally involves providing personal details, financial information, and answering a few qualifying questions. The system then processes the application and provides an almost instantaneous decision.

- Navigate to the Wells Fargo credit card application page.

- Select the desired credit card from the available options.

- Enter personal information, including your name, address, date of birth, Social Security number, and employment details.

- Provide financial information, such as your annual income and existing debt.

- Review and submit the application.

- Receive an immediate decision regarding approval or denial.

Required Information During the Online Application

The application requires comprehensive personal and financial information to assess creditworthiness. This ensures responsible lending practices and helps Wells Fargo make informed decisions.

- Personal details: Full name, address, date of birth, Social Security number, email address, and phone number.

- Employment information: Employer’s name, job title, length of employment, and annual income.

- Financial information: Current monthly income, existing debts (loans, credit card balances), and checking/savings account information.

Comparison of Application Methods

Applying online offers several advantages over in-person or phone applications. The online process is generally faster, more convenient, and provides immediate feedback.

| Method | Speed | Convenience | Feedback |

|---|---|---|---|

| Online | Fast, often immediate decision | High, can be done anytime, anywhere | Immediate approval or denial |

| In-Person | Moderate, depends on branch availability | Moderate, requires visiting a branch | Decision may take several days |

| Phone | Moderate, depends on wait times | Moderate, requires a phone call | Decision may take several days |

Step-by-Step Guide with Screenshot Descriptions

Source: tutorialsvista.com

A step-by-step guide with detailed descriptions of screenshots would enhance the user experience. Each step would be clearly illustrated with a description of the screen elements and required actions.

| Step | Screenshot Description |

|---|---|

| 1. Selecting a Card | Screenshot shows a webpage with various Wells Fargo credit card options, each displaying key features and benefits (APR, rewards, etc.). Users click on the card they want to apply for. |

| 2. Entering Personal Information | Screenshot shows a form with fields for name, address, date of birth, Social Security number, and contact information. Clear labels guide users to fill in the correct data. |

| 3. Providing Financial Information | Screenshot displays a section for employment details (employer, job title, income) and questions about existing debts and accounts. |

| 4. Review and Submit | Screenshot shows a summary page reviewing all entered information. A “Submit” button is prominently displayed. |

| 5. Application Decision | Screenshot shows a confirmation page displaying the application status (approved or denied) along with next steps. |

Managing Your Wells Fargo Credit Card Online

Managing your Wells Fargo credit card online provides a convenient way to access account information, make payments, and manage your finances. The online portal offers a range of features designed for efficient account management.

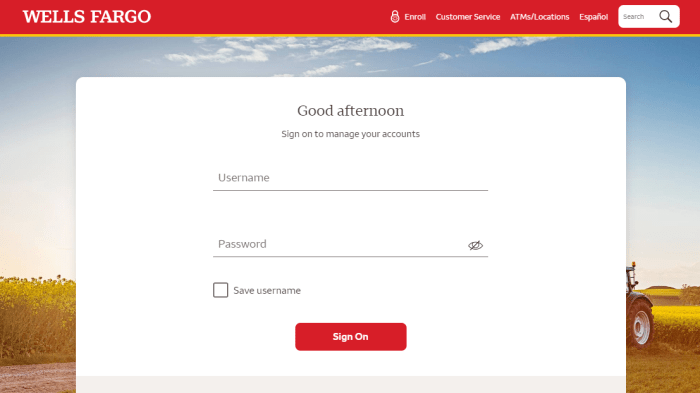

Accessing Your Wells Fargo Credit Card Account Online

Accessing your account requires logging in to the Wells Fargo website using your online banking credentials. Once logged in, you can navigate to the credit card section to view your account details.

- Go to the Wells Fargo website.

- Enter your username and password.

- Navigate to the “Credit Cards” section of your online banking dashboard.

- Select the specific credit card you wish to manage.

Making Online Payments

Online payments are a simple and secure way to manage your credit card balance. The process typically involves selecting the payment amount, choosing a funding source, and confirming the transaction.

- Log in to your Wells Fargo online account.

- Navigate to your credit card account.

- Select “Make a Payment.”

- Enter the payment amount and select the funding source (checking or savings account).

- Review and confirm the payment.

Viewing Your Credit Card Statement Online

Online access to your credit card statement eliminates the need for paper statements. You can view current and past statements, download them, and even set up email notifications for new statements.

- Log in to your Wells Fargo online account.

- Navigate to your credit card account.

- Select “View Statements.”

- Choose the statement you wish to view and download.

Disputing a Transaction Online

The online portal allows you to easily dispute transactions you believe are incorrect or unauthorized. This process typically involves submitting a detailed dispute form with supporting documentation.

- Log in to your Wells Fargo online account.

- Navigate to your credit card account.

- Locate the disputed transaction.

- Initiate a dispute by submitting the required information and documentation.

Flowchart Illustrating Online Account Management Features

A flowchart would visually represent the navigation and functionalities within the online account management system. The flowchart would begin with logging in and branch out to different features like making payments, viewing statements, and disputing transactions.

Wells Fargo Credit Card Online Security Features

Wells Fargo employs robust security measures to protect your online credit card account and personal information. These measures aim to prevent unauthorized access and fraudulent activities.

Security Measures Implemented by Wells Fargo

Wells Fargo utilizes various security protocols, including encryption, fraud monitoring, and multi-factor authentication, to safeguard customer accounts. These measures are regularly updated to adapt to evolving threats.

- Encryption: Data transmitted between your computer and Wells Fargo’s servers is encrypted to prevent interception.

- Fraud monitoring: Wells Fargo actively monitors transactions for suspicious activity and alerts customers to potential fraud.

- Multi-factor authentication: This adds an extra layer of security by requiring multiple forms of verification (password and a one-time code) before granting access.

Setting Up and Managing Online Security Features

Setting up and managing security features is typically done within the Wells Fargo online banking portal. Users can enable and disable features like two-factor authentication and manage their security preferences.

Juggling your Wells Fargo credit card online payments? Maybe it’s time to streamline your finances. Consider opening a dedicated business account for better organization; check out how easy it is to open a Truist business bank account to separate personal and professional expenses. Then, you can focus on managing your Wells Fargo credit card online more effectively, knowing your business funds are safely tucked away.

- Log in to your Wells Fargo online account.

- Navigate to the “Security Settings” or similar section.

- Enable or disable security features as desired (e.g., two-factor authentication).

- Review and update your security preferences regularly.

Potential Online Security Risks

Despite robust security measures, online credit card management carries inherent risks. Users must be vigilant to protect their accounts from potential threats.

- Phishing scams: Beware of emails or websites that attempt to steal your login credentials.

- Malware: Install and maintain up-to-date antivirus software on your devices.

- Weak passwords: Use strong, unique passwords for your Wells Fargo account.

Comparison of Wells Fargo’s Security Features with a Competitor (Chase)

Both Wells Fargo and Chase utilize strong security measures, but specific features may differ. Both banks typically offer multi-factor authentication, encryption, and fraud monitoring. A detailed comparison would require examining their specific policies and technologies.

Best Practices for Maintaining Online Credit Card Security

Following best practices significantly reduces the risk of online security breaches. These practices emphasize proactive security measures and vigilance.

- Use strong, unique passwords.

- Enable two-factor authentication.

- Regularly review your account statements for unauthorized transactions.

- Be cautious of phishing emails and suspicious websites.

- Keep your antivirus software updated.

- Use a secure internet connection.

Wells Fargo Credit Card Online Customer Service

Wells Fargo provides various online channels for accessing customer service support related to your credit card. These options offer convenient ways to address inquiries and resolve issues.

Ways to Contact Wells Fargo Credit Card Customer Service Online

Several online methods allow you to reach Wells Fargo credit card customer service. These include online help centers, FAQs, and secure messaging within your online account.

- Online Help Center: Access FAQs and troubleshooting guides.

- Secure Messaging: Send a message directly to customer service through your online account.

- Live Chat (if available): Engage in real-time chat with a customer service representative.

Common Online Customer Service Issues and Resolutions

Common issues often involve account access problems, payment inquiries, and transaction disputes. The online resources and customer service representatives can provide solutions.

- Account access issues: Password resets, account recovery.

- Payment inquiries: Confirming payment status, understanding payment methods.

- Transaction disputes: Submitting a dispute form, tracking the dispute status.

Submitting a Complaint or Feedback Online

Wells Fargo typically provides online forms or channels for submitting complaints or feedback. This allows customers to formally express concerns and provide input.

- Locate the feedback or complaint form on the Wells Fargo website.

- Fill out the form with detailed information about your issue.

- Submit the form electronically.

Typical Response Time for Online Customer Service Inquiries

Source: clark.com

Response times vary depending on the method of contact and the complexity of the issue. Secure messaging might have a slightly longer response time than live chat (if available).

Wells Fargo Credit Card Online Rewards Programs

Wells Fargo offers various credit card rewards programs, accessible and manageable through their online platform. These programs provide incentives for cardholders based on spending habits and card type.

Accessing and Managing Online Rewards Programs

Accessing and managing rewards programs is typically done through the Wells Fargo online banking portal. Cardholders can view their points balance, redeem rewards, and track their progress.

- Log in to your Wells Fargo online account.

- Navigate to your credit card account.

- Select the “Rewards” or similar section.

- View your points balance, redeem rewards, and manage your program.

Examples of Different Rewards Programs Offered

Wells Fargo offers a variety of rewards programs, including cash back, points-based programs, and travel rewards. The specific program depends on the chosen credit card.

- Cash Back Rewards: Earn a percentage back on purchases.

- Points-Based Rewards: Earn points redeemable for merchandise, travel, or cash back.

- Travel Rewards: Earn points or miles redeemable for flights, hotels, or other travel expenses.

Comparison of Rewards Program Benefits and Drawbacks

Each rewards program has its own advantages and disadvantages. Factors to consider include earning rates, redemption options, and annual fees.

| Rewards Program | Benefits | Drawbacks |

|---|---|---|

| Cash Back | Simple, easy to understand | May offer lower earning rates compared to points programs |

| Points-Based | Flexibility in redemption options | Can be complex to understand, value of points may fluctuate |

| Travel Rewards | High value for frequent travelers | Limited redemption options if not a frequent traveler |

Redeeming Rewards Points Online

Redeeming rewards points online is usually a straightforward process. Cardholders typically select their desired reward, confirm the redemption, and the reward is applied to their account.

- Log in to your Wells Fargo online account.

- Navigate to your credit card rewards program.

- Select the reward you wish to redeem.

- Confirm the redemption and review the details.

Comparison of Key Features of Wells Fargo Credit Card Rewards Programs, Wells fargo credit card online

This table compares three hypothetical Wells Fargo credit card rewards programs to illustrate the variety of options available.

| Program Name | Rewards Type | Earning Rate | Redemption Options |

|---|---|---|---|

| Rewards Plus | Points | 1 point per $1 spent | Travel, merchandise, cash back |

| Cash Back Everyday | Cash Back | 1.5% cash back on all purchases | Statement credit |

| Travel Rewards Premier | Points | 2 points per $1 spent on travel | Flights, hotels, car rentals |

Wrap-Up

Ultimately, mastering your Wells Fargo credit card online isn’t just about efficiency; it’s about empowerment. Understanding the application process, security protocols, and customer service options empowers you to navigate your finances with confidence and control. By leveraging the online tools available, you can streamline your financial management, optimize your rewards, and resolve any issues swiftly and effectively. This deep dive has revealed the power and potential at your fingertips – the power to manage your financial well-being with ease and precision.