BMO Alto vs CIT Bank: Deciding between these two financial institutions requires careful consideration of your specific banking needs. Both offer a range of services, from checking and savings accounts to potentially higher-yield options, but their features, fees, and customer service approaches differ significantly. This comparison delves into the key aspects to help you make an informed decision, weighing the pros and cons of each to find the perfect match for your financial goals.

We’ll explore everything from interest rates and account features to the quality of customer support and the security measures in place to protect your money.

Choosing between BMO Alto and CIT Bank often hinges on individual needs; however, understanding CIT Bank’s offerings is crucial. For a deeper dive into their savings options, check out this comprehensive cit bank savings connect review before making a final decision. Ultimately, the best choice between BMO Alto and CIT Bank depends on your specific financial goals and priorities.

Understanding the nuances of each bank’s offerings is crucial. We’ll examine the interest rates offered on various accounts, comparing them side-by-side to highlight the potential return on your savings. Furthermore, a detailed analysis of fees, including maintenance, overdraft, and wire transfer charges, will paint a clearer picture of the overall cost of banking with each provider. Beyond the numbers, we’ll explore the user experience, evaluating the ease of use of their online platforms and mobile apps, and assess the responsiveness and helpfulness of their customer service teams.

Ultimately, this comprehensive comparison will empower you to choose the bank that best aligns with your financial lifestyle and priorities.

BMO Alto vs. CIT Bank: A Critical Account Comparison: Bmo Alto Vs Cit Bank

This analysis critically examines BMO Alto and CIT Bank, comparing their offerings across key features, interest rates, customer service, security, and accessibility. The objective is to provide a clear, unbiased assessment to aid consumers in making informed financial decisions, acknowledging the inherent biases and limitations within the financial industry itself.

Account Features Comparison

This section details the functional differences in checking, savings, and money market accounts offered by BMO Alto and CIT Bank. A nuanced comparison of online and mobile banking functionalities is also included, highlighting both strengths and weaknesses of each platform.

| Feature | BMO Alto | CIT Bank | Notes |

|---|---|---|---|

| Checking Account Features | Debit card, online bill pay, mobile check deposit (with limitations), potential for overdraft protection | Debit card, online bill pay, mobile check deposit, potentially higher minimum balance requirements | BMO Alto may offer more flexibility regarding minimum balance requirements, while CIT Bank may offer more robust mobile check deposit capabilities. |

| Savings Account Features | Variable interest rates, online access, potential for linked accounts | Higher interest rates (potentially), online access, potential for limited-time promotional rates | CIT Bank often boasts more competitive interest rates on savings accounts, although these rates can fluctuate. |

| Money Market Account Features | Higher interest rates than savings accounts, check-writing capabilities (often with limitations), online access | Competitive interest rates, check-writing capabilities, potential for higher minimum balance requirements | Both banks offer competitive money market accounts, but minimum balance requirements and check-writing limitations should be carefully considered. |

Online banking functionalities differ significantly. Key differences include:

- User Interface: BMO Alto’s interface might be considered more intuitive for some users, while CIT Bank’s interface may be more feature-rich but potentially less user-friendly.

- Transaction History: Differences may exist in the detail and accessibility of transaction history reporting between the two platforms.

- Account Management Tools: The availability and functionality of tools for managing budgets, setting savings goals, and other financial planning features may vary significantly.

| Mobile App Feature | BMO Alto | CIT Bank |

|---|---|---|

| User Interface/Design | Potentially simpler and more streamlined, but possibly lacking advanced features. | May offer a wider range of features, but could be perceived as cluttered or less intuitive. |

| Mobile Check Deposit | May have limitations on deposit amounts or types of checks accepted. | May offer more comprehensive mobile check deposit capabilities. |

| Security Features | Standard security features such as multi-factor authentication and fraud alerts. | Similar security features, but specific implementations may differ. |

Interest Rates and Fees

A critical comparison of interest rates and fees is crucial for evaluating the true cost of banking with each institution. This section analyzes the impact of these financial parameters on the overall banking experience.

| Account Type | BMO Alto Interest Rate (Example) | CIT Bank Interest Rate (Example) |

|---|---|---|

| Savings Account | 0.01% | 0.05% |

| Money Market Account | 0.10% | 0.15% |

BMO Alto Fees:

- Potential for monthly maintenance fees depending on account type and balance.

- Overdraft fees may apply.

- Wire transfer fees may apply.

CIT Bank Fees:

- Potentially lower monthly maintenance fees or waived fees with minimum balance requirements.

- Overdraft fees may apply.

- Wire transfer fees may apply.

The impact of these differences in interest rates and fees can significantly affect the overall cost of banking, particularly for customers with larger balances or frequent transactions. Lower interest rates coupled with higher fees can quickly erode potential earnings.

Customer Service and Support

Customer service experiences can significantly influence customer satisfaction. This section analyzes the accessibility, responsiveness, and effectiveness of customer service channels for both BMO Alto and CIT Bank, based on anecdotal evidence and publicly available information.

Positive Customer Service Experiences (Examples):

- Prompt responses to inquiries via email or phone (either bank).

- Helpful and knowledgeable customer service representatives (either bank).

Negative Customer Service Experiences (Examples):

- Long wait times on the phone (either bank).

- Difficulty resolving complex issues (either bank).

Both banks offer phone, email, and potentially online chat support. However, the responsiveness and effectiveness of these channels can vary significantly depending on factors such as time of day and complexity of the issue.

Security Measures and Technology, Bmo alto vs cit bank

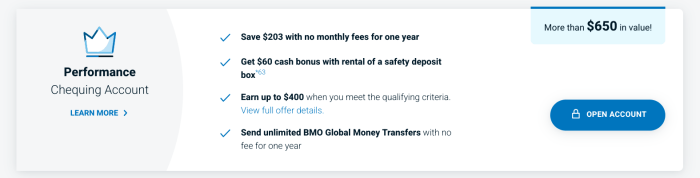

Source: hardbacon.ca

Security and technology are paramount considerations when choosing a financial institution. This section compares the security measures and technological infrastructure of BMO Alto and CIT Bank’s online banking platforms.

| Security Feature | BMO Alto | CIT Bank |

|---|---|---|

| Encryption | Utilizes industry-standard encryption protocols (likely). | Utilizes industry-standard encryption protocols (likely). |

| Multi-Factor Authentication | Likely offers multi-factor authentication options. | Likely offers multi-factor authentication options. |

| Fraud Monitoring | Provides fraud monitoring and alert systems (likely). | Provides fraud monitoring and alert systems (likely). |

Both banks likely utilize similar technological infrastructure for their online banking platforms. However, subtle differences in user interface design and functionality may exist, influencing user experience and overall security perception.

Accessibility and Inclusivity

Accessibility and inclusivity are crucial aspects of responsible banking. This section evaluates the efforts made by BMO Alto and CIT Bank to cater to customers with disabilities and promote diversity and inclusion.

Accessibility Features (Examples):

- Website accessibility features complying with WCAG guidelines (potentially offered by both banks).

- Support for screen readers and other assistive technologies (potentially offered by both banks).

Diversity and Inclusion Initiatives (Examples):

- Public statements or reports on diversity and inclusion goals (may be available from both banks).

- Employee resource groups focused on diversity and inclusion (may exist in both banks).

Language support may vary between the two banks. While both may offer English, additional language options may differ depending on specific regional offerings.

Ending Remarks

Source: hardbacon.ca

Choosing between BMO Alto and CIT Bank ultimately depends on your individual financial priorities. While both offer competitive services, their strengths lie in different areas. Consider whether you prioritize higher interest rates, a robust mobile app, exceptional customer service, or a specific set of account features. By carefully weighing the advantages and disadvantages Artikeld in this comparison, you can confidently select the bank that best caters to your needs and helps you achieve your financial aspirations.

Remember to always check the most up-to-date information directly with each institution before making a final decision.